Understanding What are Transaction Advisory Services?

In today’s fast-paced business landscape, navigating mergers, acquisitions, and other complex transactions requires strategic foresight, meticulous planning, and expert guidance. Transaction advisory services play a crucial role in facilitating these transactions, helping businesses maximize value, mitigate risks, and achieve their strategic objectives. In this comprehensive guide, we will delve into the world of transaction advisory services, exploring their significance, key components, and how they can benefit businesses of all sizes.

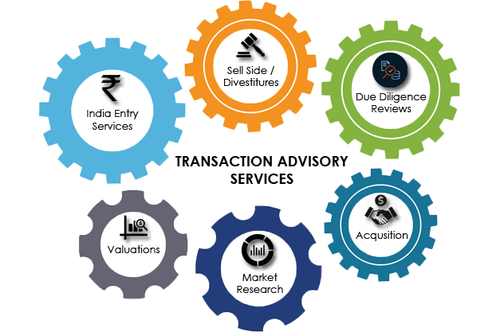

What are Transaction Advisory Services?

Transaction advisory services encompass a range of professional services aimed at supporting businesses throughout the entire transaction lifecycle. From due diligence and deal structuring to negotiation and post-deal integration, transaction advisors provide strategic insights and expert guidance to help businesses navigate complex transactions successfully. These services are typically provided by specialized teams within accounting firms, consulting firms, investment banks, and law firms, leveraging their expertise in finance, accounting, legal, and strategic planning.

Key Components of Transaction Advisory Services:

- Due Diligence: Due diligence is a critical component of any transaction, involving a comprehensive assessment of the target company’s financial, operational, and legal aspects. Transaction advisors conduct thorough due diligence to identify potential risks, liabilities, and opportunities associated with the transaction. This process helps buyers and sellers make informed decisions and negotiate favorable terms.

- Valuation: Valuation is the process of determining the fair market value of a business or asset. Transaction advisors utilize various valuation methodologies, such as discounted cash flow analysis, comparable company analysis, and precedent transactions analysis, to assess the worth of the target company or assets. Accurate valuation is essential for setting the purchase price, evaluating investment opportunities, and assessing potential returns.

- Deal Structuring: Deal structuring involves designing the transaction in a way that maximizes value and aligns with the strategic objectives of the parties involved. Transaction advisors collaborate with clients to develop optimal deal structures, considering factors such as tax implications, financing options, regulatory requirements, and risk allocation. Effective deal structuring can enhance deal certainty, minimize transaction costs, and optimize financial outcomes.

- Negotiation Support: Negotiation support is a crucial aspect of transaction advisory services, providing clients with expert guidance and representation throughout the negotiation process. Transaction advisors help clients navigate complex negotiations, resolve conflicts, and achieve mutually beneficial outcomes. By leveraging their industry knowledge, negotiation skills, and deal-making experience, transaction advisors can help clients secure favorable terms and mitigate risks.

- Post-Deal Integration: Post-deal integration is the process of combining the operations, systems, and cultures of the acquiring and target companies following a merger or acquisition. Transaction advisors play a key role in facilitating post-deal integration, helping clients execute integration plans, address operational challenges, and realize synergies. By guiding clients through the integration process, transaction advisors ensure a smooth transition and maximize the value of the transaction.

Benefits of Transaction Advisory Services:

- Expertise and Insight: Transaction advisors bring specialized expertise and industry insight to the table, helping clients navigate complex transactions with confidence and clarity. Their deep understanding of market trends, regulatory requirements, and best practices allows them to provide valuable strategic guidance and advice.

- Risk Mitigation: By conducting thorough due diligence and identifying potential risks and liabilities, transaction advisors help clients mitigate risks and avoid costly pitfalls. Their rigorous analysis and assessment of the transaction’s legal, financial, and operational aspects enable clients to make informed decisions and protect their interests.

- Value Maximization: Transaction advisors work diligently to maximize the value of the transaction for their clients. Whether it’s through accurate valuation, effective deal structuring, or negotiation support, transaction advisors strive to optimize financial outcomes and create value for their clients.

- Deal Certainty: Transaction advisors play a critical role in enhancing deal certainty by providing expert guidance and support throughout the transaction process. Their comprehensive due diligence, strategic insights, and negotiation expertise instill confidence in both buyers and sellers, increasing the likelihood of successful deal closure.

Engage with Dhiti Law Firm:

In today’s dynamic business environment, successful transactions require more than just financial expertise—they require strategic insight, meticulous planning, and expert guidance. Transaction advisory services play a vital role in facilitating these transactions, helping businesses maximize value, mitigate risks, and achieve their strategic objectives. Whether it’s navigating a merger, acquisition, or divestiture, transaction advisors provide invaluable support and expertise every step of the way, ensuring that clients achieve optimal outcomes and realize their growth aspirations. With their deep industry knowledge, rigorous analysis, and commitment to excellence, transaction advisors empower businesses to seize opportunities, overcome challenges, and thrive in an ever-evolving marketplace.